4 min read

“Risk Comes From Not Knowing What You Are Doing.”

- Warren Buffett

About The Principal

David Lazar is currently the CEO of Activist Investing which specializes in "Turnaround Situations" via Activist Investing in distressed public companies. He along with his team are actively seeking high growth private companies who are looking to explore transitioning into the public markets.

David has been involved in the Capital Markets for nearly a decade. He has diverse knowledge of financial, legal and operations management; public company management, accounting, private placements, audit preparation, capital raising, due diligence reviews, and SEC regulations.

Other expertise include: capital restructuring, reverse merger, debt financing, SPAC, equity lines, and mergers and acquisitions. David has additional experience in assisting OTC listed companies prepare for a Nasdaq Uplisting.

David has been involved in the Capital Markets for nearly a decade. He has diverse knowledge of financial, legal and operations management; public company management, accounting, private placements, audit preparation, capital raising, due diligence reviews, and SEC regulations.

Other expertise include: capital restructuring, reverse merger, debt financing, SPAC, equity lines, and mergers and acquisitions. David has additional experience in assisting OTC listed companies prepare for a Nasdaq Uplisting.

Investment Philosophy

At Activist Investing, we look for “diamonds in the rough". Companies which have long lost favour in the eyes of Wall Street and drastically need a comeback. We seek to invest in companies for which we can actively work with management in order to restore much needed shareholder value.

In other investment scenarios, when management is already on the right track, we merely invest to join in for the ride. Although this investment strategy comes with substantial high risk, we believe that it can bear great reward. Through our meticulous Due Diligence process that is conducted on every potential investment, we feel that we can properly mitigate our risk.

In other investment scenarios, when management is already on the right track, we merely invest to join in for the ride. Although this investment strategy comes with substantial high risk, we believe that it can bear great reward. Through our meticulous Due Diligence process that is conducted on every potential investment, we feel that we can properly mitigate our risk.

As Warren Buffett once said, “fearful when others are greedy, and greedy when others are fearful.”

Recent Transactions

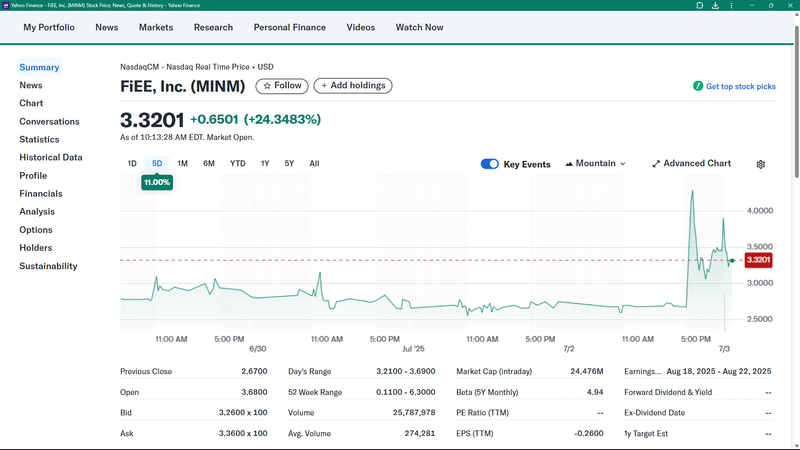

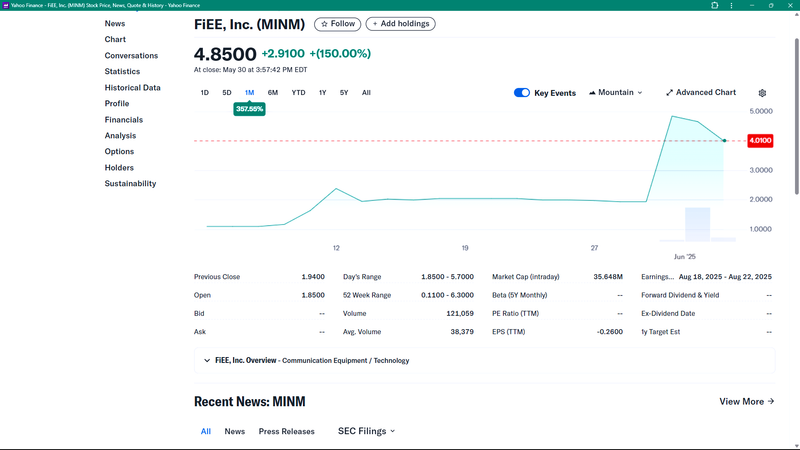

FiEE, Inc. Acquires Advanced Tech Suite Expected to Supercharge IoT-AI Content & Audience Targeting Platform

FiEE, Inc. Closes Its First Day of Trading on NASDAQ

Titan Pharmaceuticals Announces Filing of Registration Statement for Proposed Business Combination with TalenTec Sdn. Bhd.

Titan Pharmaceuticals Enters Into Merger Agreement With KE Sdn. Bhd.

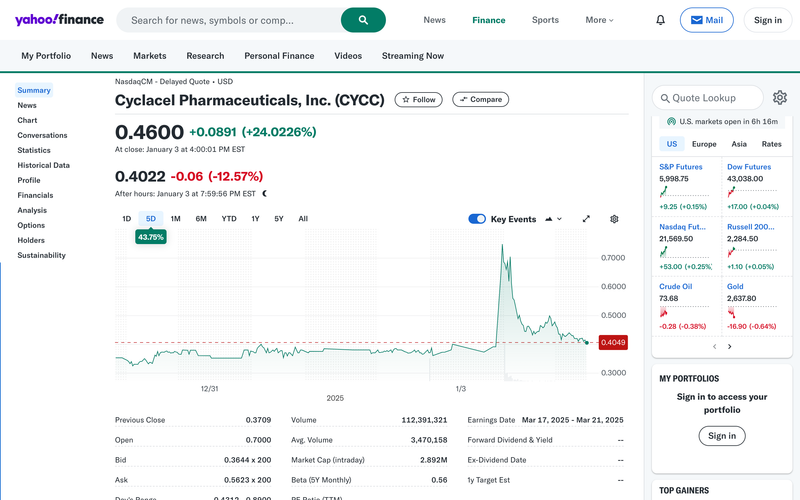

Cyclacel Pharmaceuticals Announces Closing of a Change of Control Transaction and Appointment of New Executive Leadership

Cyclacel Pharmaceuticals Announces Agreement for the Acquisition of Preferred Stock by David Lazar

LQR House Inc. Announces Change of Ticker Symbol From "LQR" to "YHC" Effective December 16, 2024

Activist investor David Lazar to invest $3M in LQR House

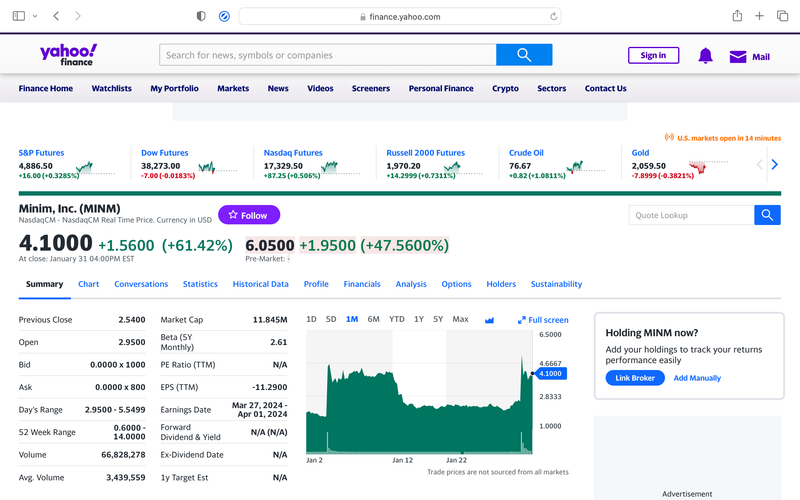

David E. Lazar Announces Ownership Interest in Minim, Inc.

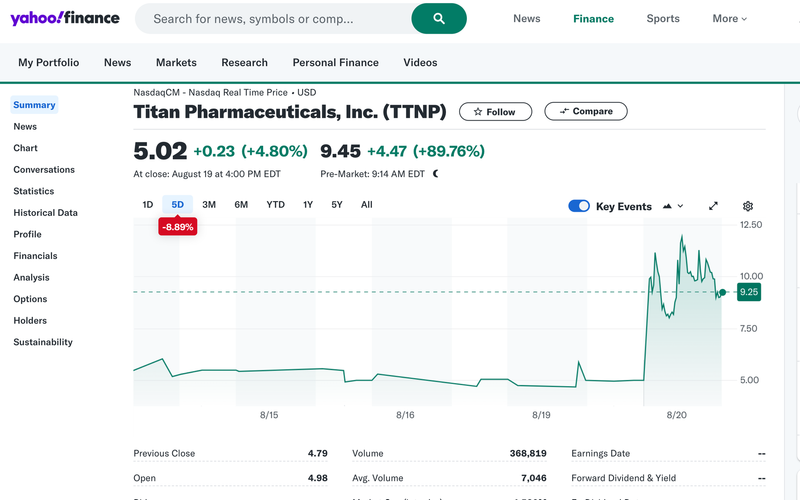

Titan Pharmaceuticals Shares Double on Reverse Merger Deal

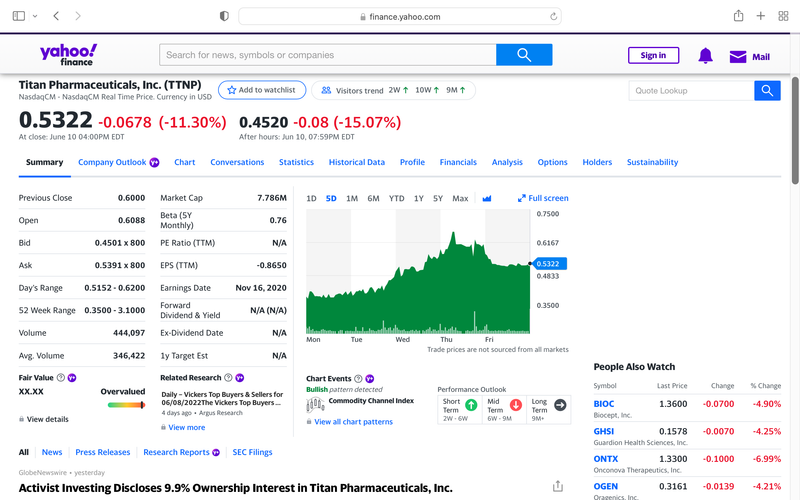

Activist Investing Discloses 9.9% Ownership Interest in Titan Pharmaceuticals, Inc.

OpGen Announces Acquisition of Preferred Stock by David Lazar

Distressed and Special Situations Investing

We invest in distressed assets from large parent companies on the private side in need of restructuring. Before any investment is made, our team assesses the division's operations, including its management team, employees, processes, and systems. Identify areas of inefficiency or weakness that may require restructuring or investment.

After acquiring the company, our main objective is to take an active role in the company's operations or working with management to implement changes that can improve the company's performance.

In The News/Blog

Read More

2 min read

Long before SPACs became a big hit on Wall St. there were “ordinary” Reverse Mergers on the Nasdaq & NYSE with small operating companies that no longer had a need to be public.

Read More1 min read

So before we begin let’s start by defining a few key terms: 1. S-1 is a registration statement filing that gets submitted for examination and final approval by the SEC. Once approved the company can raise money based upon the terms set forth within the S-1 (i.e.) minimum/maximum of…

Read More4 min read