Crypto Treasury Firms Swarm Wall Street in SPAC, Merger Boom

Source: bloomberg.com/news/articles/2025-07-11/crypto-treasury-firms-swarm-wall-street-in-spac-merger-boom

By: David Pan July 11, 2025 at 5:02 PM

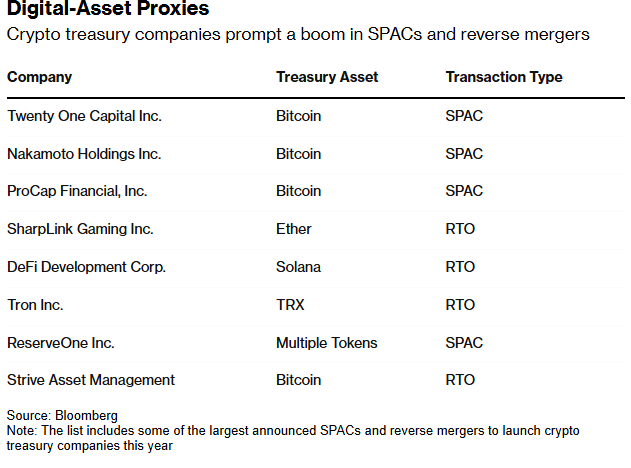

A multibillion-dollar capital markets experiment is unfolding on Wall Street, as entrepreneurs use blank-check companies and reverse mergers to take their holdings of digital assets public. Firms from SoftBank Group Corp.-backed Twenty One Capital and Justin Sun’s Tron Inc. to influencer Anthony Pompliano’s ProCap Financial Inc. are raising equity and convertible debt to buy crypto — injecting the assets into vehicles that already trade on a stock exchange, with varying degrees of financial engineering.

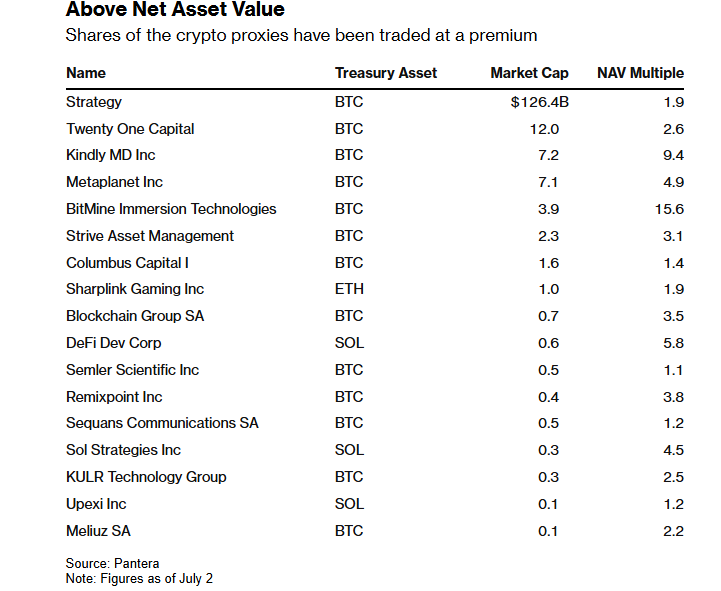

The wager: that markets will keep rewarding leveraged access to volatile tokens. That’s even as short sellers like Jim Chanos warn the model only works in the good times — and retail investors may be left holding the bag if token premiums vanish.Regardless, these newcomers are joining a wave of public companies modeled on Strategy, the software maker that famously transformed itself into a roughly $70 billion Bitcoin-holding juggernaut. The equity markets have assigned Strategy a premium of as much as 200% over its net asset value, making it a high-octane ride on the ups and downs of the world’s largest cryptocurrency.

The firm led by Bitcoin evangelist Michael Saylor is today valued at more than $120 billion, inspiring much smaller imitators to take a fast track to accumulating a horde of their own: raise cash, crypto or both; find an ailing penny stock or a SPAC without a target; and announce a deal.For dealmakers who cultivated crypto relationships through the industry’s troubled years — not to mention who hung in during the post-pandemic collapse of the SPAC boom — now is the time to cash in.

While Strategy gives a lot of work to large global banks when it comes to convertible bond and preferred stock deals raising funds for Bitcoin purchases, mid-tier and boutique investment banks are heading up the dealmaking for Saylor’s rivals. The blank-check vehicle merging with Twenty One is sponsored by an affiliate of Cantor Fitzgerald LP; Pompliano’s firm is combining with a Cohen & Co.-linked vehicle.

Keefe, Bruyette & Woods has had roles on traditional IPO and share sale activities for crypto sector firms like Galaxy Digital Inc. and crypto-adjacent companies like eToro Group Ltd. and Marex Group Plc. The appeal of blank-checks is in their relative speed. Unlike IPOs that can take more than six months, a reverse takeover or SPAC deal can be agreed in weeks, according to Paul McCaffery, KBW’s co-head of digital assets.

A rebound in token prices and a more permissive US regulatory environment have emboldened crypto firms, leading to more deals, particularly among SPACs and reverse mergers.

“It’s taking up to 80% of my day,” McCaffery said.

KBW projects its equity capital markets business tied to digital assets, including reverse mergers, will grow more than 300% this year.

“Because of Bitcoin’s and other digital assets’ properties, treasury companies can trade at a premium to NAV,” said Christian Lopez, head of digital assets at Cohen, referring to the net asset value of the holdings. He cites “excitement around their ability to accumulate tokens and generate yield.”

The scope of the playbook has expanded beyond Bitcoin, opening up even more potential flavors of back-door listings.

BitMine Immersion Technologies Inc. was a microcap crypto miner when it announced it was becoming an Ethereum treasury firm and raising $250 million via a private placement, sending shares soaring. Tiny betting and gaming firm SharpLink Gaming Inc. stock jumped after it also embraced Ethereum and agreed a $425 million Consensys-led private investment in public equity in May. Shares of microcap fintech marketplace turned Solana treasury firm DeFi Development Corp. have also surged.

Early Shareholder Dilution

The strategy is far from risk-free. SPAC and reverse takeover structures allow corporate founders to act quickly, but raising money to buy crypto via share sales comes at the expense of diluting early shareholders. Unlike ETFs, which passively track prices, crypto treasury companies must actively manage capital, accumulate tokens, and issue equity or debt to fund operations.

The share prices of treasury plays like SharpLink and BitMine, though still elevated since their shifts in strategy, faded quickly from their initial exuberance.

The ability to scale is also a dividing line. Strategy’s large balance sheet has enabled it to tap capital markets with seemingly endless variations on funding exercises via convertible bonds and preferred shares. Most new entrants, many with under $1 billion in assets, can’t yet tap those instruments — limiting their firepower.

And of course, short sellers question how sustainable the treasury model will be when token values fall and premiums over net asset value begin to erode.

“This is one of the most actively traded speculation vehicles in the market,” said Chanos in reference to Strategy, during an interview with Bloomberg TV in June. “Other companies have now looked at this and said, we can issue equities to become a Bitcoin treasury company.

“The more and more supply we are going to see, the less and less premium we are going to have,” he said.The non-stop activity is even inviting scrutiny from some crypto insiders that are turning skeptical. When Pantera Capital dubbed digital-asset treasury firms a “new frontier,” investor Nic Carter reposted the claim on Twitter, now X, with a blunt warning: “Gonna age terribly.”

The central question, according to a recent warning from asset manager VanEck, is how these firms will navigate a downturn. The real test isn’t building a premium in a bull market — but surviving when it vanishes, said Matthew Sigel, the firm’s head of digital assets research.

“The corporate crypto treasury model is a new phase of institutional adoption,” he noted in a July report. “But managing the premium to NAV and navigating market volatility will be critical to the model’s survival.”

— With assistance from Dave Liedtka