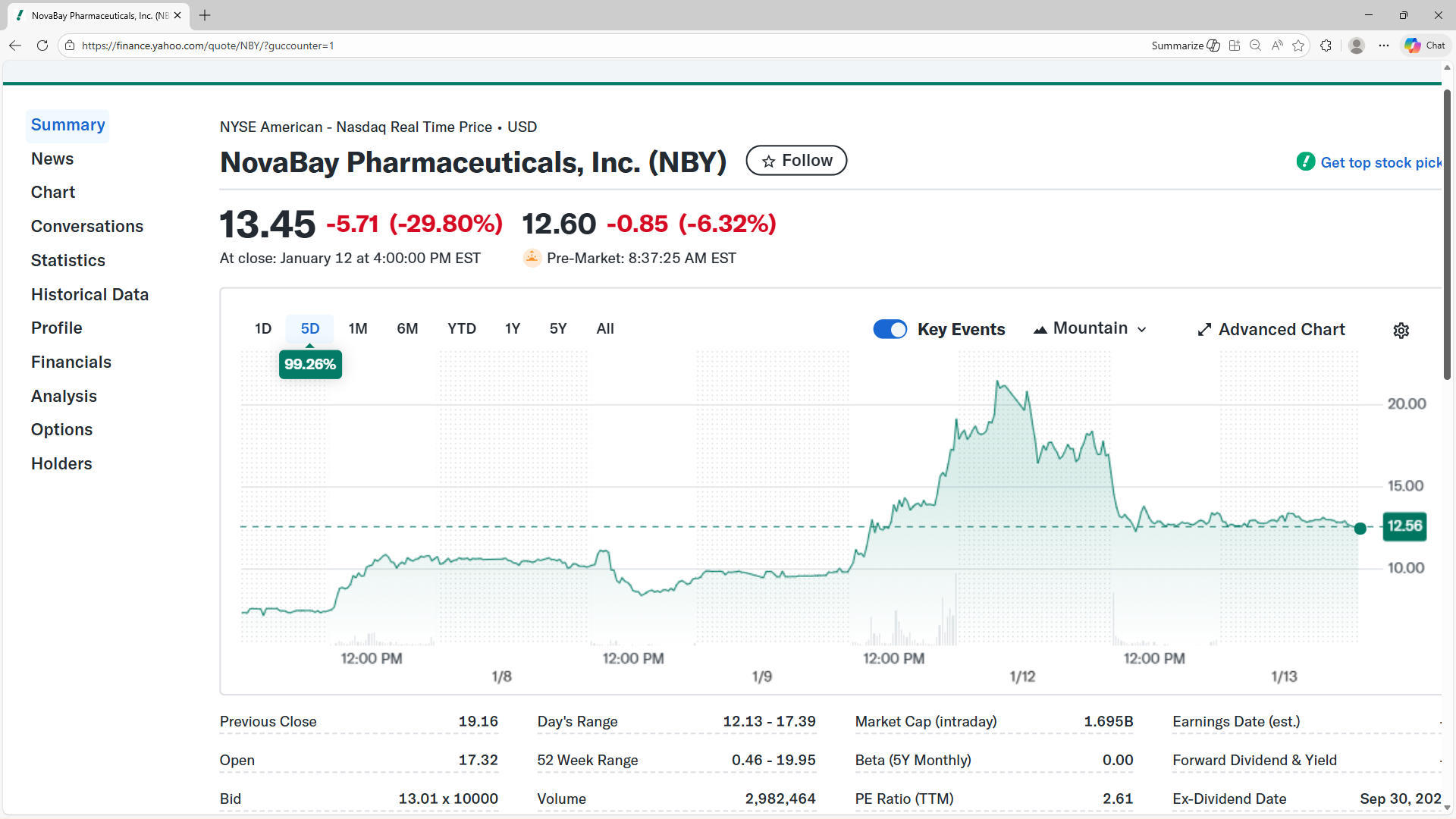

Why NovaBay Pharmaceuticals (NBY) Is Up 99.3% After Pivoting From Liquidation To Restructuring And Asset Sales

January 12, 2026

In recent days NovaBay Pharmaceuticals has attracted intense trading interest as it pursued asset sales, preferred stock designations, and leadership changes instead of outright liquidation, while working to maintain its NYSE American listing.

This combination of corporate restructuring steps and renewed focus on preserving the public listing has turned the company into a speculative focal point for investors reviewing its remaining options.

We’ll now examine how this shift toward recapitalization and asset sales, rather than dissolution, reshapes NovaBay’s investment narrative for shareholders.

What Is NovaBay Pharmaceuticals' Investment Narrative?

To own NovaBay here, you have to believe that the recent pivot toward recapitalization, preferred stock structures and asset sales can support a viable ongoing business rather than a wind‑down. The stock’s very large short‑term move, capped by a 52‑week high and triple‑digit daily surge, has turned liquidity and balance sheet repair into the central near‑term catalysts, replacing earlier focus on operating turnaround alone. Meeting NYSE American equity requirements and securing capital through Series D and Series E preferred issuances are meaningful steps, but they come with dilution concerns and uncertainty around what the streamlined company will actually look like post‑transactions. The biggest risks now sit around execution of asset sales, leadership transition and whether recent trading enthusiasm proves durable once the restructuring dust settles.

Yet this recent recapitalization push carries a key trade‑off that investors should not overlook.

NovaBay Pharmaceuticals' shares are on the way up, but could they be overextended?

Exploring Other Perspectives

NBY 1-Year Stock Price Chart

Two fair value estimates from the Simply Wall St Community span roughly US$0.12 to US$3.53 per share, underscoring how far apart individual views sit after such a powerful price move. Set that against today’s focus on recapitalization and NYSE American compliance, and you can see why many participants are rethinking both risk and remaining upside, rather than treating recent gains as a simple vote of confidence. If you are weighing NovaBay, it helps to consider several of these contrasting community perspectives alongside the shifting catalysts and restructuring risks described above.